“The Governing Council decided to increase the envelope of the pandemic emergency purchase programme (PEPP) by €500 billion to a total of €1,850 billion. It also extended the horizon for net purchases under the PEPP to at least the end of March 2022. ” – ECB Press Release. Dec. 10, 2020

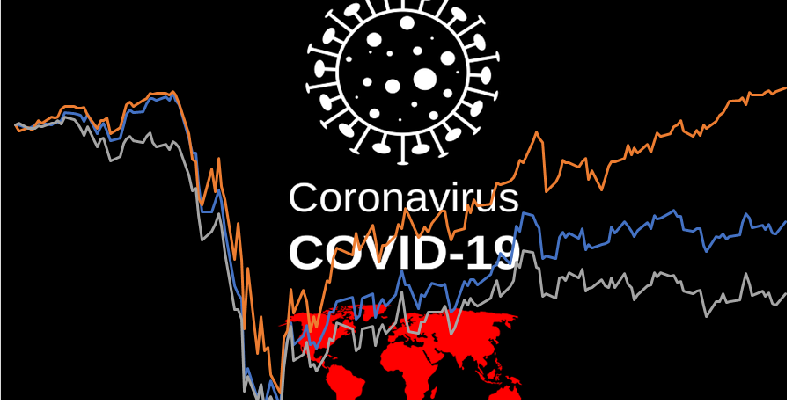

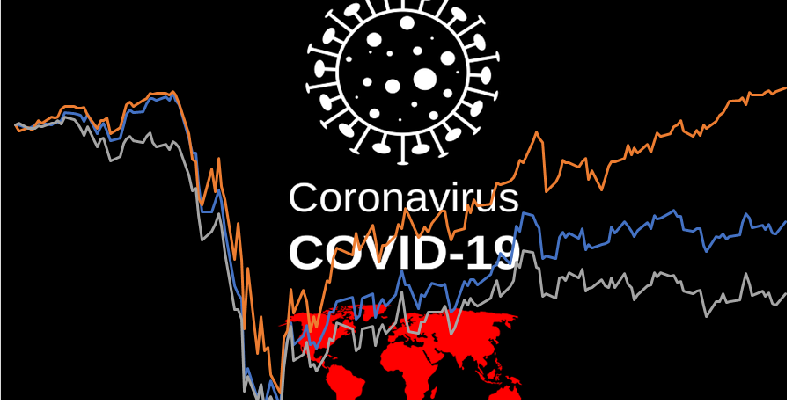

Coronavirus

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

Wave of U.S. Bankruptcies Builds Toward Worst Run in Many Years (Bloomberg)

“So far in 2020, the pace of corporate bankruptcy filings in the U.S. has already surpassed every year since 2009, the aftermath of the global financial crisis, Bloomberg data show.” – by Eliza Ronalds-Hannon, Katherine Doherty, and Davide Scigliuzzo

Italy’s future is in German hands

“As coronavirus cuts a swath of economic destruction across Europe, pushing the already-strained budgets of southern countries to the brink, calls are getting louder for the eurozone to intervene by issuing debt backed by all members.” – by Silvia Borrelli and Matthew Karnitschnig

ECB shakes off limits on new €750bn bond buying plan (FT)

“The details of the new programme support the declaration by Christine Lagarde, the ECB’s president, who said on Twitter after it was announced last week: ‘There are no limits to our commitment to the euro.’” – by Martin Arnold and Tommy Stubbington

ECB announces €750 billion Pandemic Emergency Purchase Programme (ECB)

“This new Pandemic Emergency Purchase Programme (PEPP) will have an overall envelope of €750 billion. Purchases will be conducted until the end of 2020 and will include all the asset categories eligible under the existing asset purchase programme (APP).” – ECB Governing Council

Bank of England Cuts Rate to 0.1%

“The Monetary Policy Committee at a special meeting on 19 March voted to cut Bank rate to 0.1% and increase its holdings of UK government and corporate bonds by £200 billion.” – Bank of England

France injects billions into stimulus plan amid coronavirus chaos (Politico)

“PARIS – France is trying to avoid an economic catastrophe by injecting billions into its coronavirus-hit economy.” – by Elisa Braun

Spain unveils €200B package to combat virus downturn (Politico)

“Spain’s government on Tuesday announced a package to pump €200 billion into the economy to counteract the effects of coronavirus, and the prime minister warned of “very tough days” ahead.” – by Cristina Gallardo

US Fed Cuts Rates to Zero

“The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent. “