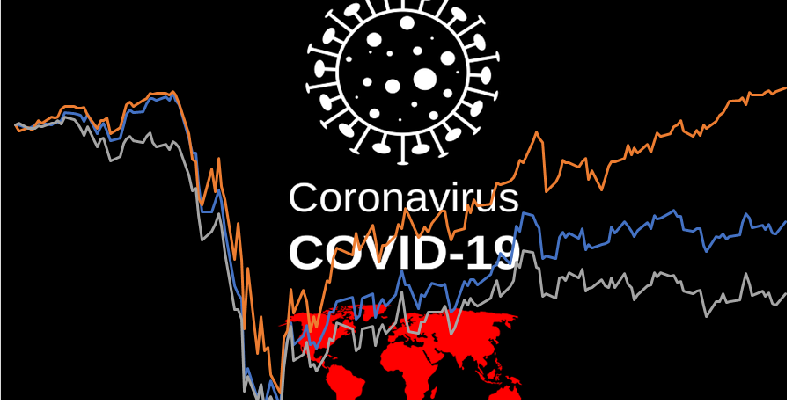

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

News | Blog

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

Investing in Europe in 2020 – The Year Ahead

An overview of some European key themes and political risks for 2020

2020 brings with it the 10th year of recovery since the global financial crisis. Equity markets continue to break records, ample credit is available, yet the bullish performance appears cosmetic at times and investing in Europe in 2020 is fraught with political risks. The US deficit doubled from $385bn to $779bn last year, the UK […]

Blood Moons, Animal Spirits and Hunting Knives

H2 2019 Europe Update

Investor trepidation towards Europe in today’s markets is understandable. Regional macro data remain anemic. Europe continues to produce weak data, Euro-Area economic sentiment saw its worst losing streak in a decade and low interest rates are set to continue throughout the medium term. Meanwhile, the Fed has raised rates nine times since December 2015, taking […]

Navigating Europe in 2019

Themes and Risks Investors in Europe to Consider in 2019

We are nearly 20 years into the new millennium and it is an unrecognizable place compared to when it started. Lehman is gone, Bear Stearns – gone, Merrill Lynch – acquired, Citigroup is a fraction of its former self. Blockbuster, Toys R Us, Woolworths are all part of the history books now. Europe, where we […]

Distressed Retail in the UK

If one ever needed tangible evidence of how much consumer habits have changed over the past decade, look no further than the UK high street. The litany of failures and restructurings continue unabated. In H1 2018 alone, the following establishments have issued announcements: Byron’s Burgers: Closing of 20 (or 30%) of its 67 premises while […]

News | Best Reads

Inflation Expectations in Europe Rise to Highest in Over a Year (WSJ)

“European inflation expectations are rising as investors anticipate ongoing easy monetary policy and a global economic rebound boosted by U.S. fiscal spending.” – by Anna Hirtenstein

Italy Government on Verge of Collapse as Renzi Party Quits (Bloomberg)

“Italy’s government led by Prime Minister Giuseppe Conte risks collapsing in the middle of the Covid-19 pandemic after a junior coalition partner pulled out.” – by Chiara Albanese and John Follain

UK-EU Brexit trade deal at a glance (Politico)

“The deal between the U.K. and the EU is the largest bilateral trade pact in history, the two sides said on Thursday. It is also the first modern trade deal to disintegrate a trading partnership, erecting and defining barriers between markets. The deal, which covers a collective market worth $905 billion as of 2019, has […]

The new EU digital regulations: Explained (Bruegel)

“Bruegel experts on digital policy to delve into the latest EU digital regulations: the Digital Services Act and the Digital Markets Act. What is the Commission proposing? What connections do these two bills have, and what policy and market implication do they have?”

Intesa, Nordea, ING, BNP Paribas most affected by ECB dividend limits (S&P Global)

“The European Central Bank has lifted its blanket recommendation against distributions, including dividends and share buybacks, but under strict conditions that will have the biggest impact on eurozone banks with high capital returns, analysts said.” – by Vanya Damyanova