Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak which, to date, has killed more than 200,000 people across Europe and almost 800,000 people globally.

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1. Investors in Europe watched the Stoxx Europe 600 shed 25% of its value within the month that lockdowns started, eradicating 6 years of gains. The forward P/E multiple on the Stoxx Europe 600 hovers around 18.0x, higher than any level investors in Europe have seen in the past 15 years but less than the 26x forward P/E multiple at which the S&P 500 trades.

EU Covid Response

In response to the pandemic, the EU has put together a historic multi-trillion euro package which includes:

- +€1 trillion EU Multiannual Financial Framework (“MFF”) Budget

- €750 billion Next Generation EU Recovery Fund

- €240 billion European Stability Mechanism

- €200 billion for businesses from the European Investment Bank

- €100 billion SURE Unemployment Reinsurance Scheme

- More than €3.5 trillion at the national level via various EU budgetary escape clauses and liquidity measures

The 7-year +€1 trillion Multiannual Financial Framework (“MFF”) Budget Agreement finalized this July, directs funds into agriculture, climate-neutrality, research and innovation, infrastructure, and digital programs including AI, and cybersecurity. The Commission’s goal is to include new digital, carbon, and plastic levies across member nations to help fund the budget.

The €750 billion EU Recovery Fund, championed by the Franco-German alliance this July, would see the European Commission issue wide-scale pan-European debt for the first time. The Union will distribute proceeds to member nations via grants and loans over the 2021 – 2023 period. Investors in Europe would be right to cheer this historic agreement. Proceeds will largely benefit Spain and Italy, where the pandemic has inflicted severe damage.

But the cracks in the Union remain and Covid has placed renewed pressure on the fissures. In the background of the pandemic, Brexit continues with no clear signs of progress. Italy was vitriolic over the EU’s and ECB’s initial responses to the outbreak; an April poll indicated that the percentage of Italians in favor of leaving the union had increased from 30% in 2018 to ~50%. Macron’s popularity in France continues to lag giving rise to eurosceptic Marine Le Pen. Both Poland and Hungary have become increasingly vocal challengers to EU legislative oversight. Even Germany took investors in Europe by surprise when local courts ruled against the ECB’s QE program this past May.

Lockdowns are cautiously easing across Europe, but the damage is palpable. The EU is forecasted to contract a further 8% in 2020 as many sectors including service, manufacture, and leisure sectors shuttered. The average budget deficit across EU countries is now expected to surge from almost balanced in 2019 to ~9% by year-end. Unemployment is expected to climb from 6.7% in 2019 to 9% by the end of 2020. Vaccines are several months away and fears of a 2nd outbreak over winter add more uncertainty to the markets.

Below is a summary of how major Western European nations have faired thus far.

France Update

The more than 30,000 Covid related deaths in France have left the country with the highest death rate (% of infected) in Europe at 16%. The Central Bank of France reported that French GDP fell 6% in Q1 and ~14% in Q2. This equates to almost 20% of France’s output disappearing over the first half of 2020. The central bank expects the French economy to contract more than 10% overall in 2020 and does not see the country returning to pre-Covid economic performance until the beginning of 2022.

France’s current economic performance presents additional hurdles to Macron’s 2022 reelection hopes. Public disapproval of Macron’s LREM political party had already been problematic before the outbreak; ongoing spats with unions and yellow vests protestors continued well into late 2019. The French president’s decision to force pension reforms through parliament last February was particularly contentious and led to two no-confidence votes from both left and right parties. By the close of 2019, Macron’s approval rating had plummeted to 25%.

To help his flailing LREM movement, Macron restructured his cabinet in July. This included ousting his French Prime Minister Edouard Philippe in favor of ex-Mayor of Prades Jean Castex. Mr. Castex, Les Républicans party member, gained public approval for crafting France’s exit from lockdown. The cabinet reshuffle is a departure for Macron as the Castex addition pulls the traditionally centrist party to the right.

Contrary to his reform policies, Macron’s support of the corporate sector during the pandemic has been well received. France has spent more than €450 billion supporting the economy, implementing a €300 billion loan guarantee program, and initiating a €3 billion fund for French SMEs. The French government also used €15 billion to bail out its ailing airline sector benefiting Airbus and Air France-KLM. The president went as far as to defer corporate taxes and ax further pension reforms from the agenda for now. The approach has garnered results; as of late June, Macron’s polling had recovered to a ~40% approval rating.

Prospects for France in the immediate future indicate continued uncertainty. Economic activity picked up more than expected between May and June post lockdown, but it is too early to gauge how sustainable this uptick will be. The CAC-40 has regained from losses sustained at the beginning of the pandemic but is still down 20% YTD. 2020 H1 earnings demonstrate how difficult an environment it has been for leading French companies. LVMH reported H1 sales down ~27% y-o-y, Kering H1 sales were off ~30%, EssilorLuxottica H1 sales are down ~30%. The turmoil in oil prices has cut Total’s sales by 32%. The coming months include several key dates for investors in Europe. In September, the finance minister, Bruno Le Maire, will present a revised support package. In October, ministers will usher in less flexible furlough schemes. Finally, France intends to end its loan guarantees programs in December.

Germany Update

Although Germany was on the precipice of a recession when the virus hit, it has weathered the fallout from the pandemic relatively well. The Bundesbank forecasts German output to fall ~7% in 2020 with growth returning to pre-crisis level in 2022. To fight the virus, Germany relaxed long-standing fiscal spending limits and announced more than €1.3 trillion in emergency measures. By June, the government had already spent more than €450 billion in cash and provided €800 billion in loan guarantees. The series of stimulus packages are expected to bring German budget deficit north of 7%.

The early and aggressive rollout of Covid testing in Germany has been held up as a success story helping to reconfirm Chancellor Merkel’s popularity. Germany’s death rate (death/infected) remains one of the lowest in Europe at just under 5%. That is not to say there haven’t been hiccups; recent outbreaks, including 1,000 new cases at a North Rhine-Westphalia based abattoir in June, have circulated news headlines as of late. However, Merkel’s success in controlling Covid-19 allowed Germany to begin phased reopening as early as mid-April

Merkel’s exit from German politics next year leaves many questions for investors in Europe. Her initial successor, Annegret Kramp-Karrenbauer (“AKK”), announced she would step down as the Christian Democrats head after a difficult start. A vote for the new CDU lead was pushed back from April to December 2020 due to the virus. Norbert Roettgen, Armin Laschet (North Rhine-Westphalia leader and Merkel ally), Jens Spahn, and Merkel’s political opponent Freidrich Merz are names to keep an eye as the December vote approaches.

The chaotic CDU leadership handover leaves the question of German chancellorship open. Since AKK’s retreat, the German public has taken notice of contenders from outside of the CDU party. Finance Minister Olaf Shultz (SPD) was polling at 48% as of July while Markus Söder, leader of the Christian Social Union (CSU – CDU’s sister party in Bavaria) led at 64%. Söder’s ‘no-nonsense’ approach to the pandemic in Bavaria gained praise. Söder has repeated to the press that he is not interested in the job. However, should he want it, current polls suggest the role is his for the taking.

In addition to the political uncertainty, investors in Europe will need to be vigilant of Germany’s continued skirmishes with the US. President Trump’s attacks on the EU and Germany in particular, have contributed to a slowdown in German trade. In the last quarter of 2019, German auto production had fallen to its lowest level in nearly 25 years. In February, the US increased European aircraft import tariffs from 10% to 15%. Next, in June, the USTR announced it was considering a further $3bn in new tariffs across a variety of European products. Soon thereafter, the US announced it would pull 12,000 troops from Germany

Despite these uncertainties, Merkel has a reason to celebrate. Germany took over the presidency of the European Council in July coinciding with the Commission’s landmark agreement on the Next Generation EU Recovery Fund. The controversy of Germany’s constitutional court decision against the ECB’s quantitative easing program seems to have subsided. The unemployment rate remains relatively low at 6% and the Bundesbank weekly activity index (WAI) suggests that activity in the real economy may be normalizing. Despite the growing debacle at payment processor Wirecard, insolvencies fell 8% in H1 2020 vs. H1 2019. The DAX, off 6% YTD, has already made up losses incurred over the last twelve months.

Italy Update

Italy was hit particularly hard by the pandemic. It was the first European country to go into lockdown after outbreaks inflicted heavy tolls in the Northern regions. To date, more than 35,000 people have died leaving Italy with the 2nd highest official death toll in Europe behind the UK. The Italian economy shrank 12% in Q2 and the Bank of Italy forecasts its economy to shrink by ~10% this year.

Prime Minister Conte’s administration has spent nearly €75 billion supporting the economy with various measures including postponing mortgage payments and delaying tax deadlines for individuals and corporations. The administration also put together a €55 billion stimulus package of which it will dedicate €15 billion to the corporate sector.

The severity with which the virus hit the country means that more than a quarter of the €750 billion EU Recovery Fund will go to Italy. €80 billion will come in the form of grants accessible in 2021 serving as a critical injection into the economy. Finance Minister Roberto Gualtieri may tap an additional €36 billion from the European Stability Mechanism if required.

Despite the external support, Italian Euroscepticism seems to be on the rise once again. Christine Lagarde’s initial claim that the European Central Bank was “not here to close spreads” did not go over well in Rome; Italian 10-year yields shot up by 40bps that afternoon. Although the ECB has retracted this position, Italy’s far-right have taken the opportunity to further promote anti-EU sentiment. The establishment of the “No Europe for Italy” party, led by ex-Five Start member Gianluigi Paragone, delivers more eurosceptic threats to the Union, as it calls for Italy to drop the Euro and leave the EU. According to a Tecné Agency poll this past April, nearly 50% of Italians are in favor of leaving the union.

Fitch downgraded Italy to BBB- in April forecasting debt to increase from ~130% to ~150% of GDP by year-end. Italy’s easing of lockdown restrictions in June has done little to spur consumer demand. Both Manufacturing Purchasing Managers and Business Activity indexes lag in the sub-50 range, indicating continued output contraction across manufacturing and service sectors. Despite its pandemic induced pain, the crisis has not had the same drastic impact on Italy’s borrowing costs. Italian 10-year yield peaked in March at 2.4% but as of late July, had dropped to just over 1%. This is a far cry from the 6% and 7% levels it reached in 2018 and 2011, respectively.

The Italian FTSE MIB, off 16% year to date, has performed better than the FTSE 100, CAC, and IBEX during the current Covid rebound. Prime Minister Conte’s proposals for a comprehensive Covid recovery plan, scheduled for mid-October, will be important for investors in Europe.

Spain Update

A relatively early March lockdown was not enough to prevent the approximately 30,000 Covid-related deaths in Spain has registered to date. The country currently holds the highest death rate per capita of the major Western European countries and the 3rd highest death toll in Europe behind the UK and Italy. Recent reports indicate that the death toll could even be closer to 45,000.

Spain’s economy suffered under a lockdown which was longer and stricter than other countries in the EU. The economy, barely recovering from the global financial crisis, contracted 18.5% in Q2, after registering a 5% fall in output over the Q1 period. Combined, Spain’s economy shrank a staggering 22% in the first half of 2020. The Bank of Spain forecasts Spanish output to contract between 9% – 15% this year, jeopardizing any prospect of post-GFC stability.

The slowdown in Spain’s auto sector, the 2nd largest in Europe (behind Germany) is partially to blame. It represents 10% of Spanish output and ~20% of the country’s exports. Lockdowns across Europe resulted in several dealership closures, leaving Spanish auto fleet sales down ~40% in H1 2020. Tourism, which represents another 12% of GDP, opened up just in time for summer, but is on questionable footing; the Spanish health ministry reported spikes in coronavirus cases over the last weeks of July. The UK, Norway, and Slovenia have each announced recent quarantine restrictions for citizens returning from Spanish holidays. This is in addition to the June ban placed on American tourists traveling to Europe.

Like other EU nations, Spain announced a raft of measures to try and prop its economy up during the outbreak. Initiatives include a €100 billion loan guarantee program announced in March and an additional €17 billion scheme for direct corporate support. It also teamed up with the European Investment Bank to offer €1.5 billion to small businesses. Since March, Spain has issued more than €35 billion in long-term paper over four syndications, each of which was oversubscribed. The most significant piece of assistance, however, will be €140 billion from the European Commission’s Recovery Fund over the next six years. Nearly half of the amount will come in the form of grants.

Despite phasing out restrictions, Prime Minister Sánchez has faced heavy criticism for his handling of the pandemic. In particular, the curtailing of regional government authority and the severity of the central government’s lockdown have been criticized. He has clashed publicly with the premiers of Andalucía, Madrid, and Valencia after excluding the regions from initial exits from lockdown. The death toll and economic performance are damaging his popularity, causing further frictions within an already weak coalition party.

Spain’s path back from the outbreak is unclear. The minority left-wing government cobbled together by Prime Minister Sánchez will struggle to survive if poor economic performance and conflicts continue. Tourist visits are down 97% and tourism sales off 71% as of June, effectively canceling any prospects for a positive 2020 summer turnout. Jobs, many of which are made up of short-term contracts in the leisure sector, are disappearing and the unemployment rate, increasing. Spanish Q2 jobless rate reached 15.3%, a level not seen since Q1 2018. This comes at a time when Spain is battling a 2nd wave of the virus. Investors in Europe who bought into Spain’s recovery are justified in feeling disappointed. The benchmark IBEX 35, not yet fully recovered from the GFC, is currently trading at lows not seen for almost a decade.

UK Update

More than 41,000 Covid related deaths have been recorded in the UK to date, making it the European nation with the highest levels of excess mortalities. The disruptions have contributed to the UK’s largest annual GDP decline in 100 years, cutting output by 20% in the Q2 2020 and even sending Prime Minister Boris Johnson into intensive care when he was infected in April. Like other countries across Europe, British service and manufacturing sectors have been especially hurt by the pandemic. The UK Composite Output Index fell to a record low of 13.4 in April before climbing back to 57 in July. The Bank of England estimates that UK GDP will contract ~10% over the year.

Noteworthy is the further demise of the UK retail sector, which had already struggled in the run-up to the pandemic. By August 2020, 49 retail companies had filed for insolvency, more than all of 2019, and quickly approaching the highest tally recorded in more than a decade. The plight has led Johnson’s administration to consider relaxing planning laws so that stores can be repurposed without the usual administrative red tape. UK Planning reforms are due for September.

To combat the economic fallout of the virus, newly installed Finance Minister Rishi Sunak introduced a raft of measures that will see the UK budget deficit increase between 13% – 21% of GDP this fiscal year; overall UK debt is now expected to reach ~ €600 billion by 2024-2025. Fitch took note of the measures by downgrading UK sovereign credit rating to AA-.

Newly installed Bank of England Governor Andrew Bailey has also had his hands full since taking over the role from Mark Carney this past March. In response to Covid, the BoE increased its target asset purchase to £745 billion, introduced an ‘unlimited’ commercial paper borrowing facility for large UK corporates, and launched alternative funding schemes for SMEs. There is even talk of the BoE considering negative interest rates or expanding the QE purchases to riskier assets.

Although the ongoing pandemic has pushed the Brexit drama into the background, the 2020 year-end deadline is quickly approaching. The European Commission needs to receive a joint proposal by October if it is to successfully coordinate a vote by the 27-member Union by the deadline. Discussions intensified in late July under a six-week push to finalize by October, however, negotiations have not fared well. Absent a bi-lateral agreement, UK/EU trade relations will revert to WTO standard terms under which tariffs on certain goods could increase by as much as 40%. Adding to the frustrations, US-UK trade discussions have been equally lackluster having started virtually in May but unlikely to conclude this year.

The UK began easing lockdown measures in May and started to show early signs of a post-Covid rebound. BoE Monetary Policy Committee member Andy Haldane even went on record to indicated that he expected a “V” shaped recovery surprising many investors in Europe. The UK PMI Composite Output Index jumped from 47.7 in June to 57.1 in July registering 3 consecutive monthly increases while housing sales have slowly ticked up and unemployment held relatively well at 4%. However, H2 2020 will prove to be critical for the UK recovery. Unemployment figures are masked by 9.6 million people relying on the emergency £60bn – £70bn furlough scheme due to end in October. Unemployment could jump to ~8% if no further measures are put in place.

The BoE recently backtracked from its V-shaped recovery hopes, pushing back the time it believes UK GDP will normalize to the end of 2021. The FTSE 100 has rebounded 16% from its Covid-induced March lows, but the relatively slow comeback suggests the UK is struggling to find its footing.

From Covid to Inflation?

Inflation? Now? It is s a counterintuitive claim; demand is falling and unemployment increasing. Governments on both sides of the Atlantic have plowed historic amounts into their economies in the fights against Covid. Across the five largest advanced economies, central bank balance sheets are expected to grow on average by 15% – 23% of GDP by 2020. Yet, despite this monetary surge, many economists expect inflation to remain low for the foreseeable future. Inflation in Europe is only forecasted to reach 0.3% in the Euro area and 0.6% for the EU overall in 2020, well below the ECB’s 2% target. Could these expectations be wrong?

Since the global financial crisis, the EU has found it challenging to push prices up to target levels. Recent QE programs (EU, Japan) have shown that expansionary monetary policy alone is no longer enough to spur inflation. In the face of unprecedented central bank expansions, inflation has risen just 1.75%, 2%, and 1.34% over the last decade in the US, UK, and EU respectively. Previous expansions, focused on asset purchases, had a direct impact on financial assets but mostly missed the real economy. This is because local banks were more likely to increase excess reserves rather than lend to the economy.

The historic stimulus packages doled out by various governments against the pandemic make this monetary influx different from that of the ’08-’09 financial crisis. Instead of relying solely on central bank asset purchases, Covid has brought about significant fiscal expansion. These include government schemes and initiatives, spending programs, tax rebates and deferrals, SME investments, and even cash payments directly to people. It is true that fiscal expansions occurred in past crises, but not to the extent seen today. Budget deficits are expected to increase to 18% of GDP in the US, 19% of UK GDP, and 9% in the EU.

Discretionary 2020 fiscal measures adopted in response to coronavirus by 15 June 2020, % of 2019 GDP

| Immediate fiscal impulse | Deferrals | Other liquidity /guarantee | |

| Belgium | 1.4% | 4.8% | 21.9% |

| Denmark | 5.5% | 7.2% | 4.1% |

| France | 4.4% | 8.7% | 14.2% |

| Germany | 8.3% | 7.3% | 24.3% |

| Greece | 3.1% | 1.2% | 2.1% |

| Hungary | 0.4% | 8.3% | 0.0% |

| Italy | 3.4% | 13.2% | 32.1% |

| Netherlands | 3.7% | 7.9% | 3.4% |

| Portugal | 2.5% | 11.1% | 5.5% |

| Spain | 3.7% | 0.8% | 9.2% |

| UK | 8.0% | 2.3% | 15.4% |

| United States | 9.1% | 2.6% | 2.6% |

Source: Bruegel (05 August 2020)

More than $8 trillion of direct and indirect fiscal-related stimulus has been directed at Covid across the globe. And though demand will remain weak until nations properly address the virus, the budgetary expansions, alongside monetary programs, increases the likelihood that the real economy will feel the impact. Furthermore, the economic slowdowns were always a result of government measures put in place for the health and safety of the public. The lockdown induced slowdowns were never the result of previous structural or economic weakness. When economies normalize (GDP is expected to gradually return to pre-Covid levels over the next 1 – 2 years), so will output, except with trillions of extra stimulus funds floating through the system. Barring any massive structural changes due to Covid (e.g. commercial or retail real estate implosion, long-term unemployment), these fiscal programs could lead to an upward impact on prices in the future.

For investors in Europe, the Union’s continued focus on climate initiatives may initially add upward pressure on prices as well. The EU has reserved 25% of the +€1 trillion MFF budget to climate action. Terms from the €750 billion Recovery Fund require EU members to present plans for green reforms. Cost estimates for infrastructure required in the EU’s Green Deal and the Unions 2050 net-zero emissions target range between €175 and €290 billion per year. In the UK, the government passed legislation in 2019 targeting a 100% reduction of greenhouse emission. The estimated the cost for UK decarbonization is £70bn / year. As companies implement decarbonization policies across Europe, capital projects and supply chain costs will likely increase. These price hikes could end up hitting the consumer.

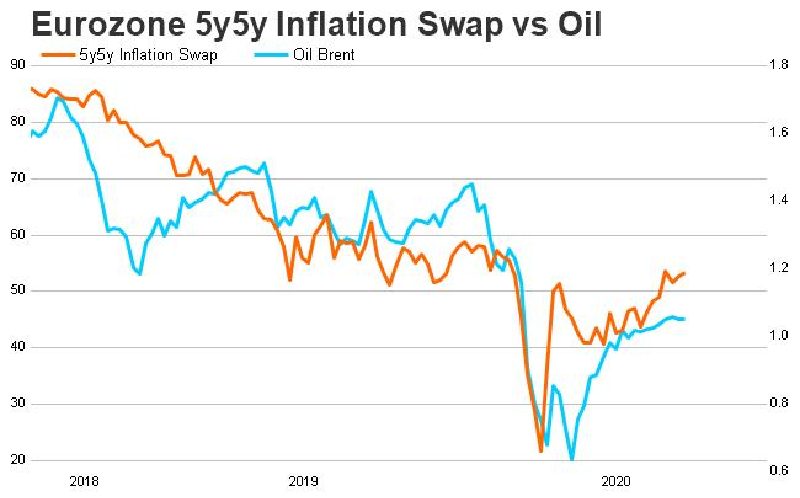

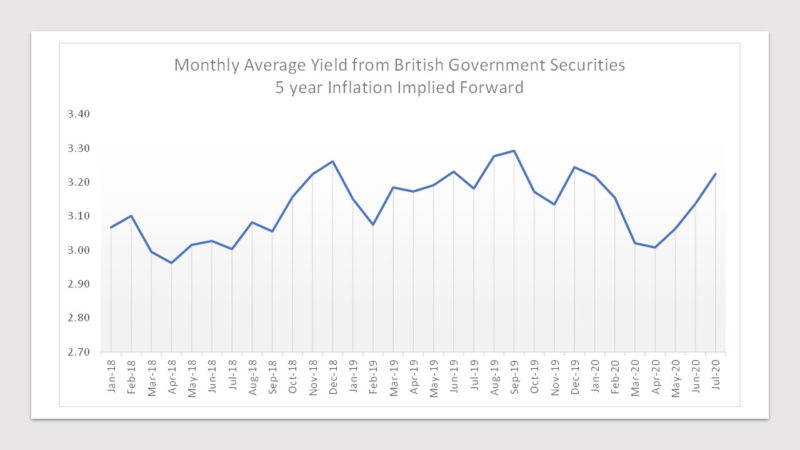

The Eurozone 5Y5Y inflation swap, which investors in Europe watched in precipitous decline over the last several years, has risen steadily since the beginning of the year. UK forward rates spiked in line with announcements of Covid support schemes by the British government. Given the above, investors in Europe might look to adjust portfolios to account for, or profit from, inflation in the medium-term while waiting for some normalcy to return.

Source: Refinitiv. Sept 01, 2020

Source: Bank of England

Over the 2nd half of 2020, European ministers will continue to work with central banks to stabilize faltering economies. Ministers will be eager to end expensive furlough programs while keeping mindful of unemployment. EU member nations will also be preparing EC applications to access their allotments of the Recovery Fund, due for distribution next year. Investors in Europe should expect applications to back significant green and digital projects as per requirements set out by the European Commission.

In parallel, Brexit negotiations will continue. Arguably, neither side wants to risk the added turmoil from a “No Deal” fall-out in the current environment; discussions are likely to trudge along in subdued form until the year-end deadlines approach.

Big pharma is making progress towards a vaccine. Sanofi-GSK has closed deals to supply the EU and UK with a solution once its remedies are proven safe. Germany’s BioNTech and CureVac have similar deals in place with various nations. In September, AstraZeneca started late-stage trials of its AZD1222 vaccine for 30,000 people in the US. Despite these advances, the prospect of finding a stable vaccine by the end of 2020 seems unlikely. Infectious disease experts warn that a COVID-19 resurgence may come this winter. This comes at a time when Brexit still threatens to significantly disrupt EU/UK relations, US presidential and congressional elections are underway, and furlough programs are potentially ending. As a result, investors in Europe should expect markets to pick up in volatility as we head towards the end of 2020.

Anthony Ugorji

CEO